The best travelling credit card that ensures you save more while reaping the benefits of spending, the UOB PRVI Miles Card is the name of the game.

Collect UNIRinggit reward points with UOB PRVI Miles Card

UNIRinggit Reward Points (UNIRM Points) are designed to reward you for spending with the UOB PRVI Miles Card. Depending on the types of transactions you have made with this travel credit card, you can get up to 5 times UNIRM Points. Let's see the breakdown of UNIRM Points that you may earn:

- 5 UNIRM Points for every RM1 transaction made overseas (no capping), airlines, hotels and travel agencies spend (with a combined spending of RM5,000)

- 1 UNIRM Point on all other types of spending

- Additional 2,000 UNIRM Points with a minimum of 3x retail spends at RM10 minimum, per month (terms apply)

Also subject to UOB PRVI Miles Card's terms and conditions, your accumulated UNIRM Points are valid for 3 years only. So don't forget to redeem them with notable airline partners and other rewards available.

Air miles redemption

A travel credit card is not complete without its air miles redemption program. With the UOB PRVI Miles Card, you can redeem air miles with accumulated UNIRinggit Reward Points from notable frequent flyer programs such as AirAsia BiG Points, Cathay Pacific Asia Miles, Malaysia Airlines Enrich Miles and Singapore Airlines KrisFlyer Miles.

The steps to redeem air miles are very simple as well. All you need to do is head over to the UNIRinggit Rewards Catalogue to find out the conversion rate for each frequent flyer program and you're already one step ahead!

Exclusive GrabRide deals with Grab Malaysia

Exclusively for UOB PRVI Miles cardholders, you get to enjoy this exclusive deal in collaboration with Grab Malaysia:

- 50% off on Grab Rides (up to RM10 off per transaction), capped at 4x redemption every month. Please insert this promo code: PRVIRIDE to enjoy this perk!

Annual fee of UOB PRVI Miles Card

The annual fee of this travel credit card is RM198 for the Principal card, while the Supplementary card is RM30.

Note: In addition, eligible cardmembers whose application is submitted during the Campaign Period of the RinggitPlus flash deal and successfully approved by UOB Malaysia will be entitled to enjoy a 1-year annual fee waiver. You can check our page to find out more about the flash deal.

List of documents to prepare to make an application

If you are a salaried employee, please prepare:

- A copy of your IC (both sides)

- Latest 3 months' salary slips OR the latest EPF statement

- Latest 6 months' bank statements

- Latest BE form with an official tax receipt

If you are self-employed, please prepare:

- A copy of your IC (both sides)

- A copy of Form 9, 24 & 49 OR Business Registration Certificate

- Latest 6 months' company bank statements

- Latest B form with an official tax receipt

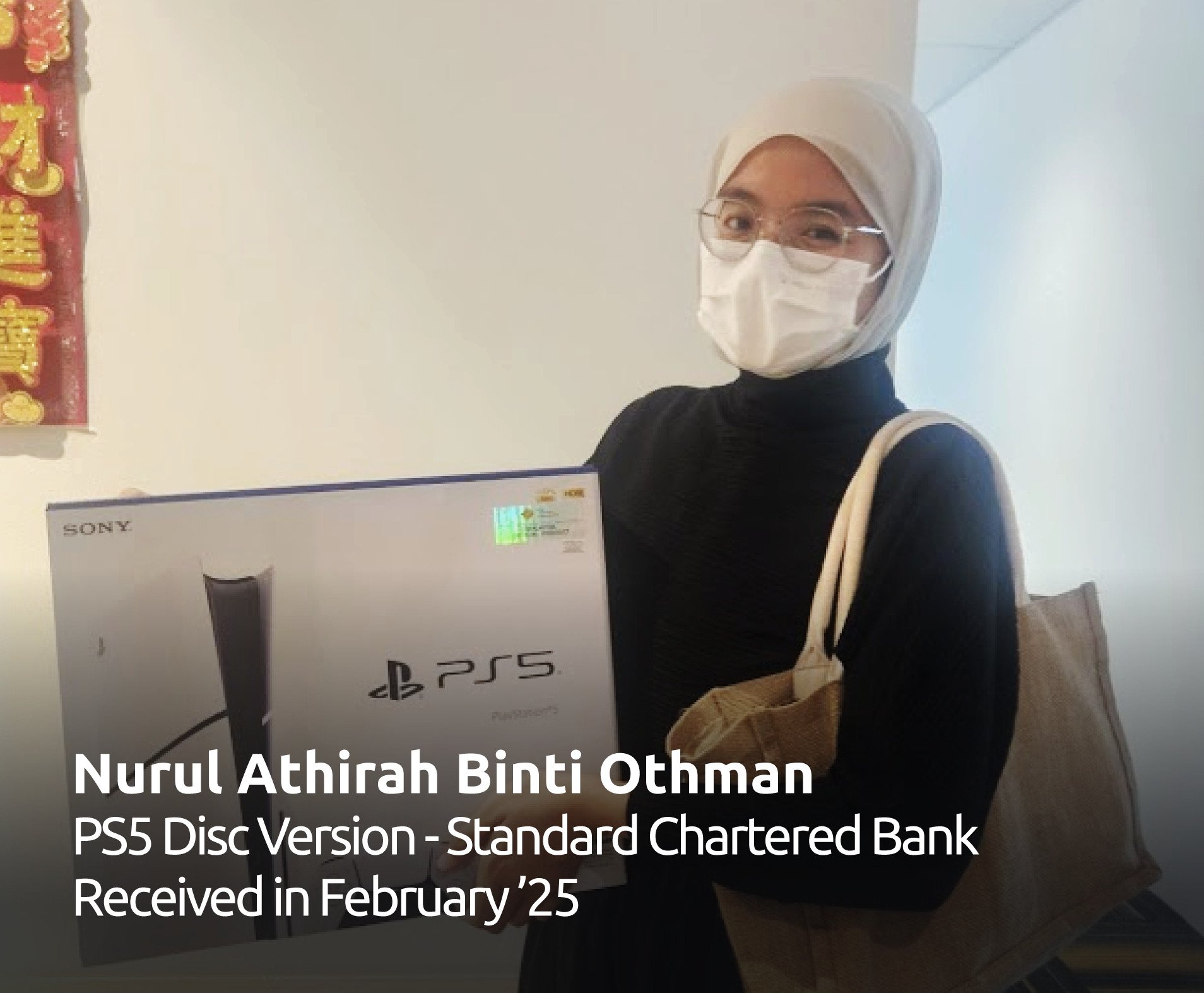

5X UNIRM for overseas spend

5X UNIRM for overseas spend